Published on Thursday, 31 May 2018 at 2:15:58 PM

On 25 May the Shire of Merredin placed a notice in the Phoenix which publically advertised the Shire’s proposal to apply ‘differential rates’ on Unimproved Values (UVs) for rates in the 2018/19 financial year. Submissions were invited in relation to the information placed in the notice. However the Shire has had a number of enquires in relation to what differential rates are and why do we need them. With the 30th June rapidly approaching, the Shire felt it was timely to remind the community how our rates work in Merredin.

Why do we have Rates?

Rates are an annual payment made by residents for living in a Local Government area.

We have rates because they are a simple and effective way of paying for the delivery of vital community services and infrastructure such as roads, footpaths, parks, libraries and leisure centres – just to name a few.

How do Rates work?

The amount you pay in rates each year depends on the basis of valuation applied to your property. This valuation is determined by the Valuer General's Office, an independent State Government organisation.

The basis of valuation is either Gross Rental Value (GRV) or Unimproved Valuation (UV). For non-rural properties the Gross Rental Value (GRV) is used and for rural properties the Unimproved Value (UV) is used. The GRV is an estimate of the rent a property could earn in a year. The UV refers to the site value of the property. GRV's and UV's are reassessed every third year and annually, respectively.

Based on valuation, rates are calculated each year and an annual rate notice is issued to you. You'll usually receive your notice in July of each year. More detailed information about property valuations is available from Landgate.

What are Differential Rates? Why do we employ them?

Differential Rates have actually been in place in Merredin for a number of years but as per the Local Government Act 1995, the Shire is required to give public notice each year and call for submissions.

Council has adopted a differential rating approach in an attempt to ensure that rate revenue is collected on an equitable basis. It is only applied to UV (rural properties) because of the diversity we have in our rural zone properties which are categorised as Rural, Urban Rural, Mining, Special Zone Wind farm, Special Use Airstrip and Merredin Power.

Further information about the Shire’s ‘Objectives & Reasons for the Proposed Differential Rates for 2018/19’ can be found on the Shire’s website.

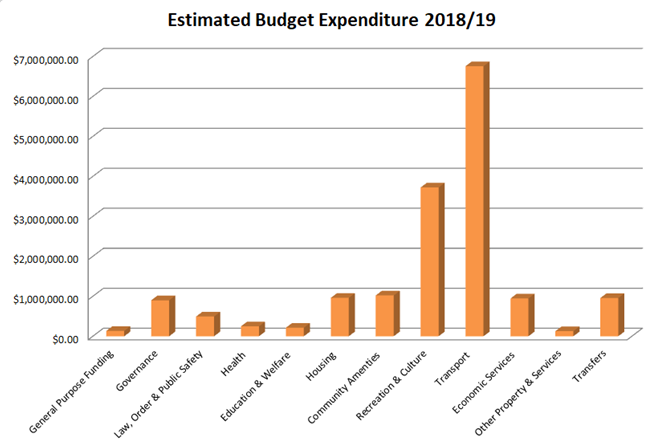

What will my Rates be spent on for 2018/19?

The draft budget is yet to go to Council for adoption (this will occur at Council’s ordinary meeting scheduled for 17 July) but the following graph provides an approximation of how much Council will spend on the various services it provides to the community.

In Merredin it has remained best practice for a number of years to increase rates annually by 3% - no more, no less. This is regardless of the CPI and rate of inflation which have remained steady in recent years around 1.5 – 3% annually. The Shire is able to comfortably continue to provide the same level of services that our rate payers have come to expect.

Rates however, are a complicated topic so for further information please contact Charlie Brown (Executive Manager Corporate Services) on 9041 1611 or email emcs@merredin.wa.gov.au. Charlie handles the compilation of the draft Budget to present to Council and is more than happy to answer questions from community members around the budget process and rates in general.

* * *

Back to All News